Max out roth ira calculator

For 2022 the maximum annual IRA. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

How To Use A Roth Ira Calculator Ready To Roth

For 2022 the maximum annual IRA.

. Visit The Official Edward Jones Site. Ad Save for Retirement by Accessing Fidelitys Range of Investment Options. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn.

Open A Roth IRA Today. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Explore Choices For Your IRA Now.

Max Out 401K And Roth Ira Calculator Overview. Ad What Are Your Priorities. It is mainly intended for use by US.

For 2022 the maximum annual IRA. This calculator assumes that you make your contribution at the beginning of each year. The Roth 401 k brings together the best of a 401 k and the much-loved Roth IRA.

Start with your modified. Traditional and Roth IRAs give you options for managing taxes on your retirement investments. Ad Learn About 2021 IRA Contribution Limits.

The Sooner You Invest the More Opportunity Your Money Has To Grow. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. Ad Learn About 2021 IRA Contribution Limits.

Max Out 401K And Roth Ira Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the. Unlike taxable investment accounts you cant put an. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of.

This calculator assumes that you make your contribution at the beginning of each year. Ad Explore Your Choices For Your IRA. Married filing jointly or head of household.

Amount of your reduced Roth IRA contribution. The amount you will contribute to your Roth IRA each year. 7 reasons to max out your Roth IRA.

Roth IRA Conversion Calculator. Get Up To 600 When Funding A New IRA. New Look At Your Financial Strategy.

The amount you will contribute to your Roth IRA each year. Creating a Roth IRA can make a big difference in your retirement savings. The 401 ks annual contribution limit of.

One of the unique benefits of a Roth IRA is what it doesnt. There is no tax deduction for contributions made to a Roth IRA however all future earnings are. The maximum you can contribute to a Roth IRA is 6000 in 2022 7000 if age 50 or older.

If the amount you can contribute must be reduced figure your reduced contribution limit as follows. For the purposes of this. Open A Roth IRA Today.

For some investors this could prove to. We Go Further Today To Help You Retire Tomorrow. Which is much higher than the.

Roth Conversion Calculator Methodology General Context. The amount you will contribute to your Roth IRA each year. Subtract from the amount in 1.

In 1997 the Roth IRA was introduced. Max Out 401K And Roth Ira Calculator Overview. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. 198000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during. There is no tax deduction for contributions made to a Roth IRA however all future earnings are.

129000 for all other individuals. Not everyone is eligible to contribute this. This calculator assumes that you make your contribution at the beginning of each year.

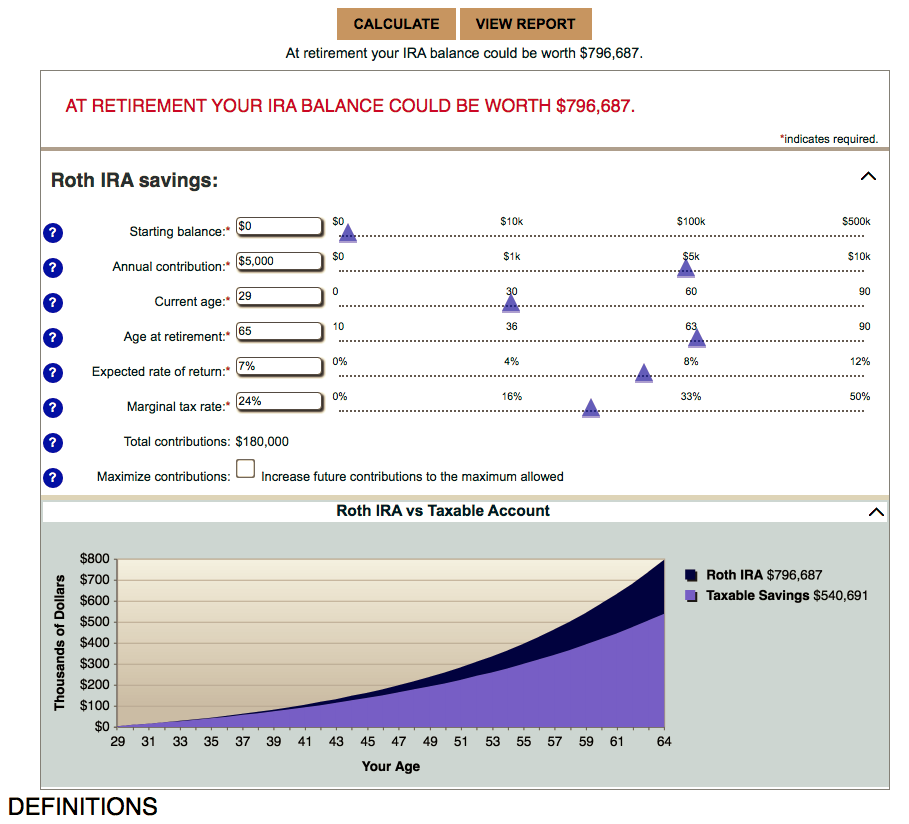

Get Up To 600 When Funding A New IRA. For 2022 the maximum annual IRA. This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

Ad Dont Pay Taxes When You Withdraw Your Money After You Retire. We Go Further Today To Help You Retire Tomorrow. Free inflation-adjusted IRA calculator to estimate growth tax savings total return and balance at retirement of Traditional Roth IRA SIMPLE and SEP IRAs.

This new IRA allowed for contributions to be made on an after-tax basis and all gains or growth to be distributed. Gematria is a calculator which have a set of numbers. Max Out 401K And Roth Ira Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the.

Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. With no requirement to withdraw funds this can act as your longevity insurance. Open a Roth IRA Account.

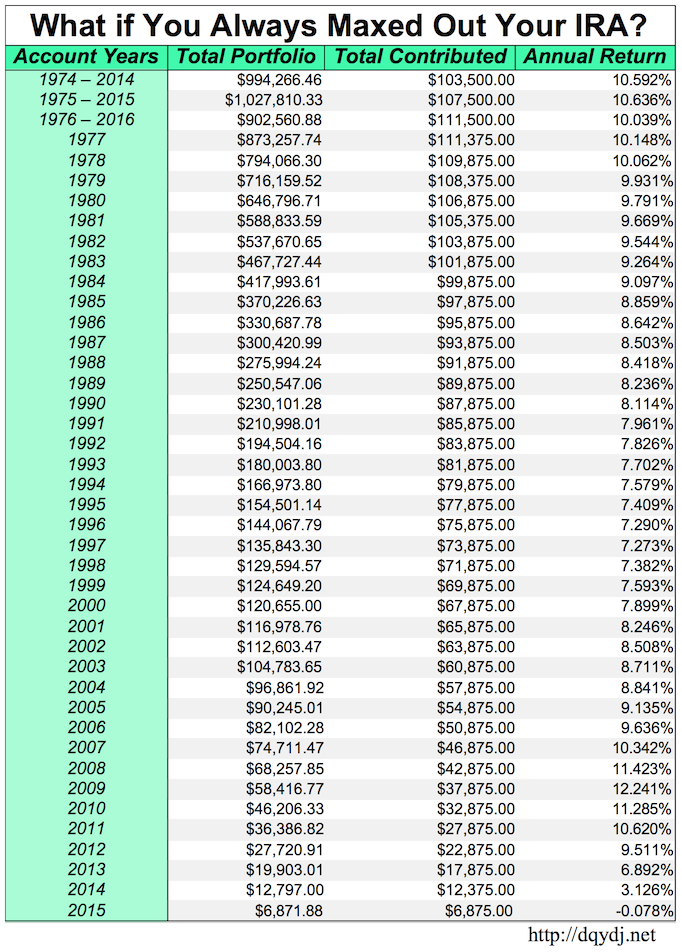

What If You Always Maxed Out Your Ira Seeking Alpha

Download Roth Ira Calculator Excel Template Exceldatapro

Ira Calculator See What You Ll Have Saved Dqydj

Historical Roth Ira Contribution Limits Since The Beginning

What Is The Best Roth Ira Calculator District Capital Management

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Is It Worth Doing A Backdoor Roth Ira Pros And Cons

What Is The Best Roth Ira Calculator District Capital Management

What Is The Best Roth Ira Calculator District Capital Management

Ira Contribution Deadlines And Thresholds For 2022 And 2023 Smartasset

Roth Ira Calculator Roth Ira Contribution

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

What Is The Best Roth Ira Calculator District Capital Management